Bank Exams 2025 - Notification, Exam Dates, Admit Card, Result

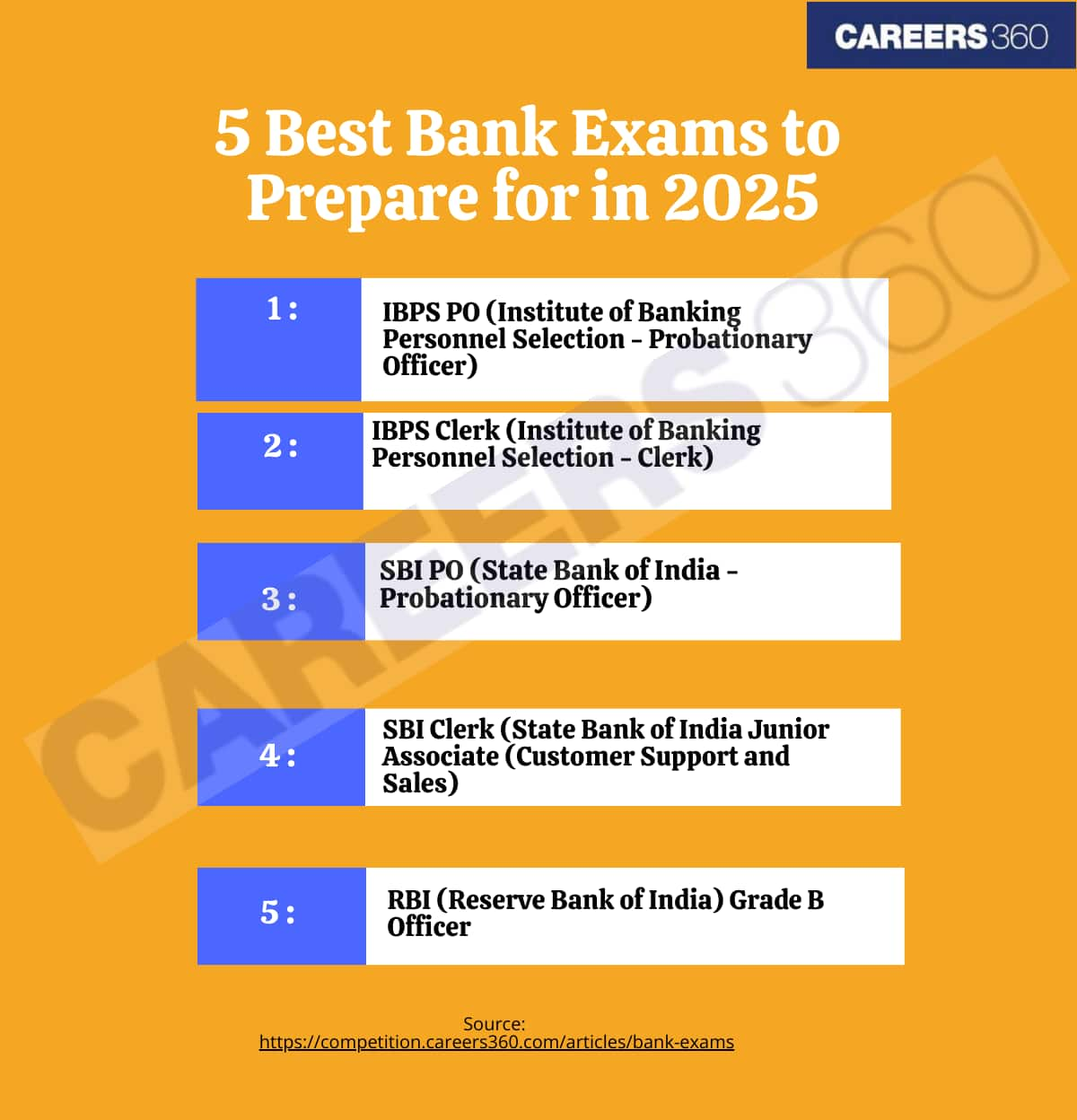

Bank Exams 2025 - Millions of candidates appear for the bank exams every year in India to build a successful career in the banking sector. Public sector and private sector banks announce vacancies for various posts throughout the year, however, some of the most sought-after posts for the banking exam aspirants include Probationary Officer, Clerk, Specialist Officer, RBI Assistant, RBI Officer Grade B, and Officer Grade I, II and III. Careers360 here enlists the most popular bank exams in 2025 for your reference. Have a look at the Bank exam 2025 list and know what is needed to appear and crack any of the below mentioned bank exams in 2025.

Latest: The revised IBPS 2025 Calendar was released online on the official website - ibps.in.

This Story also Contains

- Bank Exam Dates 2025

- Banking Exams Eligibility Criteria 2025

- Top Government Bank Exams in India

- IBPS Exams (IBPS RRB, IBPS PO, IBPS SO)

Bank Exam Dates 2025

Applicants can check the details of the some Bank exams 2025 to keep themselves updated about the Bank events in 2025. Students are advised to keep track of important Bank exam dates 2025.

Bank Exam Dates 2025

Exams | Dates 2025 |

| Prelims - To be announced Mains - To be announced | |

| Prelims - To be announced Mains - To be announced | |

| Prelims -October 4, 5 & 11, 2025 Mains - November 29, 2025 | |

| Prelims -August 17, 23, 24, 2025 Mains - October 12, 2025 | |

| Prelims -August 30, 2025 Mains - November 9, 2025 | |

| IBPS RRB exam date 2025 | Prelims: Scale I - November 22, 23, 2025 Office Assistant - December 6, 7, 13, & 14, 2025 Mains: Scale I - December 28, 2025 Office Assistant - February 1, 2026 Single Exam: Officer Scale II & III - December 28, 2025 |

| RBI Assistant exam dates 2025 | To be announced |

Banking Exams Eligibility Criteria 2025

Most of the banks have similar eligibility criteria for PO, Clerk, SO, Assistant, and Grade B. However, it’s just the age criteria which differs a little from post to post.

Bank Exams 2025 – Age limit Eligibilit

Exam name | Education Eligibility | Age Limit |

Graduation | 18-40 years | |

Graduation | 20-30 years | |

Graduation | 20-28 years | |

Graduation/Post Graduation | 20-30 years | |

RBI Assistant Eligibility Criteria | Graduation | 20-28 years |

Graduation | 21-30 years | |

Graduation | 21-30 years | |

Graduation | 21-28 years | |

BOB PO Eligibility Criteria | Graduation | 20-28 years |

BOB SO Eligibility Criteria | Graduation | 21-35 years |

Indian Bank PO Eligibility Criteria | Graduation | 20-30 years |

ICICI Bank PO Eligibility Criteria | Graduation | 27 years |

Top Government Bank Exams in India

RBI Exams (RBI Assistant and RBI Officer Grade B)

RBI Assistant Examination - RBI Assistant exam is held in two phases – preliminary and mains, followed by a Language Proficiency Test (LPT). The final selection of the candidates is done based on the overall performance of the candidates in main the and Language Proficiency Tests. Selected candidates are paid a starting basic salary of Rs. 14,650 per month i.e. Rs. 13,150 plus two advance increments and other allowances. Currently, the starting salary of RBI Assistants is around Rs. 32,528.

RBI Officer Grade B Exam - RBI Officer Grade B examination is conducted for the recruitment of General Officers, and officers in the Department of Economics and Policy Research (DEPR) and the Department of Statistics and Information Management (DSIM). Candidates opting for recruitment in Grade B DR General have to appear for Phase I and Phase II exams in online mode, while for recruitment into DEPR and DSIM, candidates have to take three papers – Paper I, II and III. The final selection of the candidates will be based on the merit lists, prepared by adding marks in Phase-II and Interview in case of General recruitment and by adding marks of Paper II & III and interview for DSIM and DEPR.

IBPS Exams (IBPS RRB, IBPS PO, IBPS SO)

Institute of Banking Personnel Selection (IBPS) conducts IBPS Clerk, IBPS RRB, IBPS PO and IBPS SO exams.

IBPS (Institute of Banking Personnel Selection) RRB Exam - IBPS RRB exam is held for the recruitment of candidates as Office Assistants, Officer Scale I, II and III in online mode across the regional rural banks. Candidates, who have opted for Office Assistants, have to take the preliminary and mains exam, while candidates interested for the post of Officer Scale I have to appear in prelims, mains and interview. Candidates, who aspire to be Officers in Scale II & III levels need to appear for Online Single Exam and interview only.

IBPS (Institute of Banking Personnel Selection) PO Examination - IBPS PO examination is held by Institute of Banking Personnel Selection (IBPS) in online mode. The examination is held in three phases – prelims, mains and Interview, for the recruitment of Probationary Officers/Management Trainees across the 20 participating banks of IBPS. Candidates who take prelims exam, must qualify in it to be able to appear in the subsequent stage of the exam – mains.

Further, they have to qualify the mains exam to be able to appear in the Interview. As per the marking scheme of IBPS PO, candidates get 1 mark for each correct answer, while 0.25 or 1/4th marks are deducted for each incorrect answer. For final selection of the candidates, the combined marks of mains and Interview are considered.

IBPS (Institute of Banking Personnel Selection) Clerk Exam - IBPS Clerk exam is conducted in two stages – prelims and mains. IBPS Clerk prelim paper has three sections - English Language, Numerical Ability, Reasoning Ability. Each section carries weightage of 30, 35, 35 marks respectively. IBPS Clerk exam has four sections wherein separate time is allotted for all 4 sections for 200 marks. Each correct answer fetches 1 mark, while for every incorrect answer, 0.25 mark is be deducted.

IBPS (Institute of Banking Personnel Selection) SO Examination - Institute of Banking Personnel Selection (IBPS) Specialist Officers (SO) or IBPS SO exam is held in three stages – prelims, mains and interview. The exam pattern of different posts like Law Officers, Rajbhasha Adhikari, IT Officer, Agriculture Field Officer, HR/Personnel Officer and Marketing Officer varies. However, for all the posts, the negative marking is applicable. 1/4th or 0.25 marks are deducted for each incorrect answer. The exams for these posts include questions from English, General Awareness, Reasoning, Quantitative Aptitude, Hindi, and Professional Knowledge.

SBI Bank Exams 2025 – (SBI PO, SBI Clerk, SBI SO)

The State Bank of India (SBI) conducts banking exams like SBI Probationary Officer (PO), SBI Clerk and SBI Specialist Officer (SO).

SBI PO Examination - SBI Probationary Officer or SBI PO exam is held by the State Bank of India for the recruitment of Probationary Officers across the various branches of the bank. The SBI PO exam is conducted in three stages – prelims, mains, and group exercises (GE) & interview. Each correct answer gets 1 mark, while 0.25 marks are deducted for each incorrect response.

SBI Clerk Examination - Unlike SBI PO, interviews are not conducted in SBI Clerk exam. SBI Clerk is held in two stages only – prelims and mains. Selected candidates are posted in the clerical cadre across different branches of SBI. Only those candidates are considered eligible for mains who qualify the prelims exam. The prelims SBI Clerk exam has questions from English Language, Numerical Ability, Reasoning Ability, while mains have questions from General/Financial Awareness, General English, Quantitative Aptitude, Reasoning Ability & Computer Aptitude. Each correct answer will fetch 1 mark, while each incorrect answer will get -0.25 or -1/4.

Banking Exams 2025 - Independent Bank Exams (BOB PO, BOB SO)

Bank of Baroda conducts BOB PO and BOB SO exams for the recruitment of Probationary Officers and Specialist Officers respectively. The exam pattern of BOB PO and BOB SO is on the same lines of IBPS PO, IBPS SO and SBI PO and SBI SO.

BOB PO Exam - BOB PO exam is held in three stages – Online exam, Psychometric test, Group Discussion and Personal Interview (GD/PI). Candidates have to qualify all the stages, after which they have to undergo an a-nine-month Post-Graduate and Certificate program in Banking and Finance in the Bank of Baroda. The online exam has objective and descriptive questions.

The objective type carries four sections - Reasoning and Computer Aptitude, English Language, Quantitative Aptitude and General/Banking/Economy Awareness. This section has 165 questions for 200 marks. In the descriptive section, candidates have to write one essay and one letter for 50 marks, in 3 hours. Each incorrect answer fetches a negative marking of 1/4th.

Qualified candidates of the online exam have to take a psychometric test wherein they have to complete an assessment test within a certain time limit. Further, the qualified candidates of online test and the psychometric test have to appear for GD/PI where they may be asked questions related to banking and finance, current events, general awareness etc. The final merit list is prepared on the basis of marks secured in online exam and GD/PI.

BOB SO Examination - In BOB SO examination, candidates have to appear in an online test and Group Discussion (GD)/Personal Interview (PI)/Psychometric Test. BOB SO is held by Bank of Baroda for the recruitment of Junior Management Grade/Scale I, MMG/S II – Middle Management Grade/ Scale II, MMG/S III – Middle Management Grade/Scale III in legal, sales and operations departments of Bank of Baroda.

The online test has 200 questions for 200 marks from Reasoning, English Language, Quantitative Aptitude, and Professional Knowledge. The test has to be completed in 2 hours. Each correct answer is awarded 1 mark, while 0.25 or 1/4th marks will be deducted for each incorrect answer.

Psychometric Test/GD/PI is held for the candidates who secure the minimum qualifying cut off marks in the online test. Psychometric Test/GD/PI is conducted to assess the personality, level of communication, clarity & problem solving innovativeness, level of efficiency, willingness to work in any part of the country, suitability for the post etc. of the candidates. The minimum qualifying marks for GD/PI are 60% (General) and 55% (Reserved).

Top Banking Exams List 2025

Bank Exams 2025 - Independent Bank Exams (Indian Bank PO, SO, Clerk)

Indian Bank PO Exam - Indian Bank PO examination is held at three stages – Prelims, Mains and Interview. The prelims exam is held for 100 questions for 100 marks. Questions are asked from English, Quantitative Aptitude and Reasoning Ability wherein candidates are given 1 hour to complete the test. The mains exam is conducted for 3.30 hours, wherein 157 questions are asked for 225 marks.

The 155 questions are asked from Reasoning & Computer Aptitude, General/Economy/Banking Awareness, English Language and Data Analysis & Interpretation, while 2 questions for 25 marks are for English letter writing and essay writing. Candidates who qualify in the prelims, have to take the mains examination, while candidates qualifying in the mains exam are eligible to appear in the interview to be conducted by the bank.

Candidates are allotted marks out of 100 in the interview wherein the minimum qualifying marks are 40% for General and 35% for SC/ST/OBC/PWD candidates. The combined final score is arrived at by giving a weightage of 80% to the mains exam and 20% to the interview score.

Indian Bank SO - Indian Bank SO there’s no examination, as candidates are directly shortlisted for interview based on their eligibility. However, a preliminary screening test may be held in case the number of applications received is huge. The screening test, if held, is qualifying in nature. The screening test will be held for 1 hour wherein candidates will be asked 60 questions for 60 marks from professional knowledge.

The qualifying marks for the screening test are 50% for the general category and 45% for reserved category candidates. Through Indian Bank SO, candidates are recruited as Assistant General Manager, Manager, Senior Manager, Chief Manager across various departments of the bank.

Indian Bank Clerk - The exam is held in two stages – written test (objective and descriptive) and interview. Candidates qualifying in the written test are shortlisted for appearing in the interview.

Private Banking Exams 2025 – (ICICI Bank PO)

ICICI Bank PO Examination - The ICICI Bank PO exam includes an online aptitude test, online psychometric test, case-based group discussion and personal interview. The online aptitude test consists of 60 questions for 60 marks from Verbal Ability, Analytical Ability and Numerical Ability. Candidates have to complete the test in 1 hour wherein there is no negative marking.

Through the psychometric test, candidates are tested on their qualities such as leadership, teamwork, handling events, etc. Further, candidates who qualify in the ICICI PO exam aptitude test, are shortlisted for the GD and on the same day have to appear for personal interview. Apart from ICICI, there are some other private banks too which conduct their own banking exams.

Frequently Asked Questions (FAQs)

Yes, some of the IBPS bank exams can be cleared with 3 months of preparation.

Most of the bank exams are conducted in online mode only.

Probationary Officer, Clerk, and Specialist Officer are some posts recruited by SBI, IBPS and others.

Yes, definitely, candidates recruiting through bank exams are getting a good salary and also other allowances too.

Candidates will be able to apply for the bank exams through online mode on the official websites.

Questions related to SBI PO

On Question asked by student community

Hello Aspirant,

Generally, having vitiligo does not prevent you from working in a bank like SBI as a PO or Clerk, or in other banks.

Bank eligibility primarily focuses on:

-

Educational qualification

-

Age limit

-

Nationality

-

General good health

Vitiligo is a skin condition that affects pigmentation and is not typically a disqualifying medical condition for banking roles. Unlike certain armed forces positions that have very strict physical appearance or performance standards, banking jobs usually do not have such specific requirements regarding skin conditions.

Your ability to perform the job duties, your skills, and your qualifications are the main factors considered. While you will undergo a medical examination, vitiligo itself is generally not a barrier. Always refer to the specific job notification's medical fitness guidelines for the role you're applying for.

If your parents’ income exceeds the OBC NCL limit this year, you should apply under the General category for IBPS PO and SBI PO recruitment. Previous years' applications under OBC NCL do not affect the current year's eligibility if income criteria change.

Hello aspirant ,

I hope you are doing well. As per your mentioned query , practising previous year question papers helps you to find the difficulty level of an exam . You also get to know about the exam pattern , important topics as well. It will boost your preparation.

Here are the links below , you can get previous year question papers for both exam in online mode.

https://competition.careers360.com/articles/ibps-po-question-papers

https://competition.careers360.com/articles/sbi-po-question-papers

Revert for further query!

Good luck !

Hi Akarsh,

The eligibility for the SBI PO exam is based on specific age criteria mentioned in the official notification.

SBI PO Age Criteria :

- Minimum Age : 21 years.

- Maximum Age : 30 years.

- Age relaxation is provided for reserved categories as per government norms.

If you're being declared ineligible, it could be due to an incorrect interpretation of the cut-off date. A mismatch in the information you provided during the application.

You can check out the given link to know more.

Best wishes!

Hello Saurav,

It is unlikely to create a problem during the document verification (DV) process, as long as the university name on your certificates matches the details provided in your application form. However, since your college (ABC) is affiliated with XYZ University, it's important that the certificates or documents you present clearly show the relationship between the two.

To be on the safe side, you can:

-

Check your documents: Ensure that the university name (XYZ) is correctly mentioned, and that it doesn't cause confusion with your college (ABC).

-

Include the affiliation information : If possible, mention in your application or provide a separate document stating that your college is affiliated with XYZ University.

-

Clarify during DV (Document Verification): If any questions arise, you can clarify this during the document verification by showing the affiliation of your college with the university.

If the documents are genuine and correctly reflect your academic background, this minor discrepancy should not pose a major issue.

I hope this answer helps you. If you have more queries then feel free to share your questions with us we will be happy to assist you.

Thank you and wishing you all the best for your bright future.

Applications for Admissions are open.

Apply for Online M.Com from Manipal University